Will Heath/NBC via Getty Images

- Elon Musk said on Tuesday he has limited ability to take action on dogecoin.

- Only a day earlier, he called for developers to submit ideas to upgrade the digital token.

- Musk seems to favor dogecoin even more, especially after somewhat backtracking on bitcoin.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Elon Musk said on Tuesday he isn't formally associated with dogecoin and has little control over its development.

"Please note Dogecoin has no formal organization & no one reports to me, so my ability to take action is limited," he tweeted, responding to a Twitter user who referred to him as the "Doge CEO."

The billionaire's tweets on the meme-inspired cryptocurrency have often triggered big rises in the price, which has led to the dogecoin community to call out for more of his support.

Musk had issued a call to developers on Tuesday to submit ideas for dogecoin upgrades in order to improve its technology. He said he prefers it over other cryptocurrencies because "Doge has dogs & memes, whereas the others do not."

This comes days after Tesla suspended bitcoin transactions for its electric-vehicles, and said it was looking at other less energy-intensive cryptocurrencies as alternative payment mechanisms.

The billionaire called the joke currency a "hustle" earlier this month during his "Saturday Night Live" hosting appearance, tanking its price almost immediately.

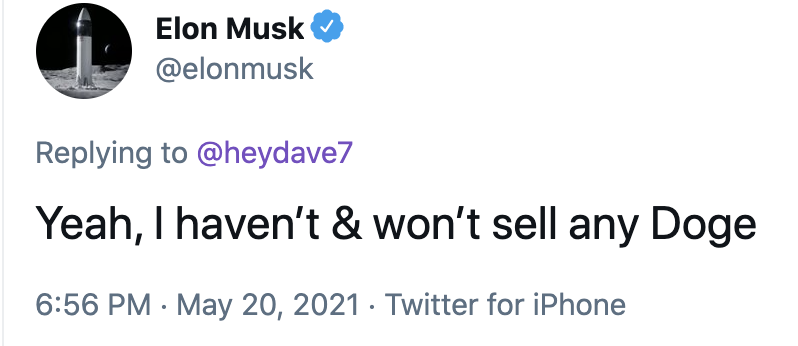

But he recently clarified he hasn't and does not plan to sell any of his dogecoin holdings.

Dogecoin was last trading 2% higher at 35 cents on Wednesday, according to data from Coinmarketcap.

Other influential crypto advocates like Mike Novogratz have not been as passionate about the digital asset. The Galaxy Digital CEO recently told Goldman Sachs it is much more speculative than bitcoin, it doesn't have long-term potential because institutions aren't buying it, and eventually retail investors will lose interest.

But others feel it's up to investors to assess how they want to treat dogecoin and the profits they end up with from trading in it. The dog-themed crypto was created by enthusiasts mostly for fun, according to Michael Sonnenshein, CEO of Grayscale Investments.

"That drills home the point that it's important for investors to scrutinize use cases and whether the asset is viable and has the potential to gain real world traction by solving a real world problem versus a solution in search of a problem that may not exist," Sonnenshein told Goldman Sachs last week.